AASB Sustainability Reporting Standards

Mandatory Climate Disclosures Are Here!

Is Your Business Ready for the ASRS?

Aligning Australian Sustainability Reporting Standards with Global Requirements

Australia has recently introduced internationally aligned climate-related and sustainability reporting standards, which require financial reporting through the Australian Sustainability Reporting Standards (ASRS), Australian Accounting Standards Board (AASB) S1 and S2. These standards are based on the ISSB framework, which integrates the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, tailored to the Australian legal and institutional environment. The standards provide a framework that allows disclosures to be globally consistent and provide comparable information on sustainability-related risks and opportunities.

Understanding the AASB S1 and S2 Sustainability Reporting Standards

AASB S1 is a voluntary standard focusing on sustainability-related risks and opportunities, encompassing environmental, social, and governance (ESG) factors that may impact financial performance.

AASB S2 is a mandatory standard that focuses on climate-related risks and opportunities, including both physical and transition risks, that could reasonably be expected to affect the entity’s cash flows, access to finance, or cost of capital over the short, medium, or long term.

Both S1 and S2 have identical core content pillars (governance, strategy, risk management, metrics and targets).

Governance

Disclose how risks and opportunities are governed at both the board and management levels.

Strategy

Disclose how risks and opportunities impact your organisation’s strategy, financial performance, and resilience.

Risk Management

Disclose how risks and opportunities are identified, assessed, prioritised, and monitored.

Metrics and Targets

Disclose how risks and opportunities are measured, monitored, and managed.

Core Disclosures Under AASB S1

AASB S1, when voluntarily applied, requires an entity to disclose information about its sustainability-related risks and opportunities. These include detailing:

- Governance: The board’s oversight of sustainability-related risks and opportunities, integrating sustainability into strategy, risk management, and major transactions, while outlining management’s role in governance implementation, risk monitoring, and progress tracking toward sustainability targets.

- Strategy: The impact of sustainability-related risks and opportunities on the business model, value chain, strategy, financial position, and cash flows over different time horizons, while assessing the resilience of the entity’s strategy to these risks.

- Risk Management: Resilience to sustainability-related changes, developments and uncertainties through scenario analysis, risk evaluation criteria, monitoring methods, and risk assessment processes, along with how these processes are integrated into the entity’s overall risk management framework.

- Metrics and Targets: The metrics to measure and monitor sustainability-related risks and opportunities, its performance and progress towards targets, as well as how they are calculated and whether they are validated by third parties.

Why Entities May Elect to Apply this Standard

Voluntary adoption enables organisations to strengthen governance, enhance business resilience by preparing for sustainability risks, and demonstrate accountability through transparent and proactive reporting. Early alignment with the S1 can help address material ESG risks, meet stakeholder expectations, strengthen reputation and drive long-term value.

How Cress Can Help

With our expertise in ESG reporting and disclosure, Cress can help your business identify the most material ESG risks and opportunities as well as stakeholder concerns that are specific to your operations. We also help you identify industry trends and peer performance, assess risks relevant to your business, and provide transparent and clear disclosures to key stakeholders interested in your financial reports. We can also help your business design a sustainability strategy that manages risk and uncovers opportunities for internal efficiencies, strengthening the long-term success of your business.

Core Disclosures Under AASB S2

AASB S2 requires reporting entities to disclose information about climate-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term. These include detailing:

- Governance: The board’s oversight of climate-related risks and opportunities, integrating sustainability into strategy, risk management, and major transactions, while outlining management’s role in governance implementation, risk monitoring, and progress tracking toward targets.

- Strategy: The impact of climate-related risks and opportunities over different time horizons on the business model, value chain, strategy, and financial performance, the role of transition planning, and climate-related scenario analysis to assess climate resilience, uncertainty, and adaptation capacity.

- Risk Management: Resilience to climate-related changes, developments and uncertainties through scenario analysis, risk evaluation criteria, monitoring methods, and risk assessment processes, along with how these processes are integrated into the entity’s overall risk management framework.

- Metrics and Targets: Climate-related metrics and targets, performance and progress reporting across Scope 1, 2, and 3 greenhouse gas emissions, transition and physical risks, capital deployment, carbon pricing, reliance on carbon credits and an analysis of progress.

Climate disclosures must be made in a sustainability report, which will sit alongside its financial counterpart in an entity’s annual report.

Does the Sustainability Report Require an Audit?

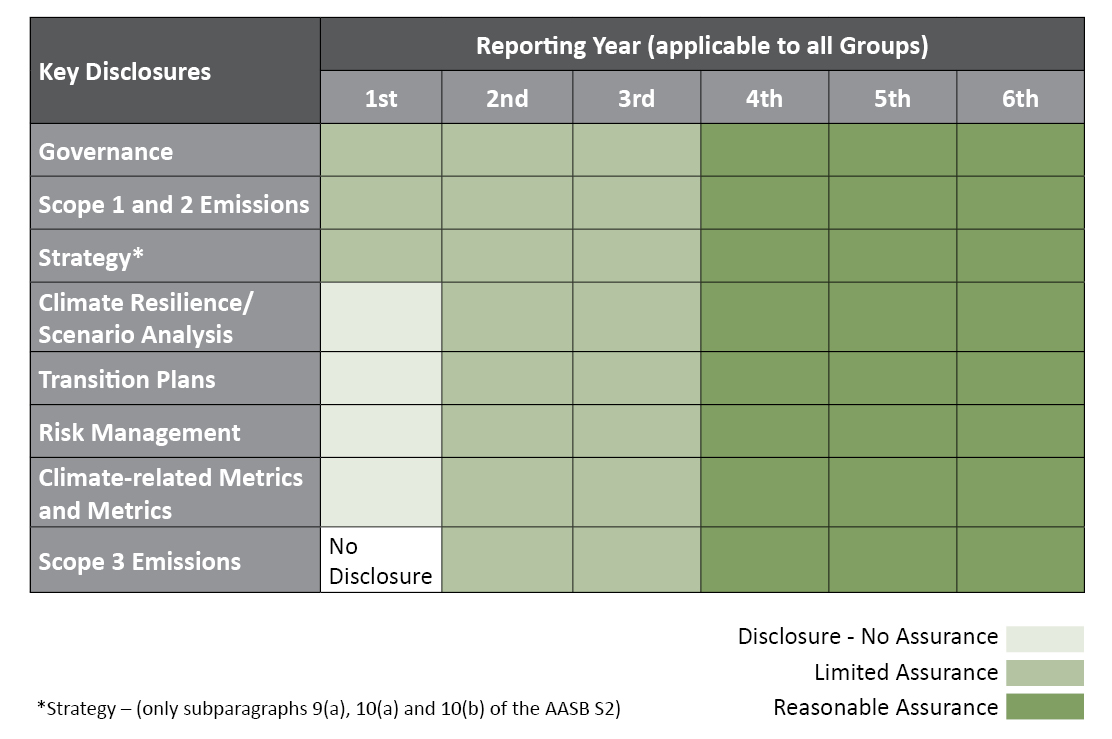

Yes, under the Corporations Act 2001, sustainability reports must be audited under the ASSA 5000 General Requirements for Sustainability Assurance Engagements under the Australian Auditing and Assurance Standards Board (AUASB). AUASB has introduced a phase-in period, during which different sections of AASB S2 Climate-Related Disclosures will be subject to varying levels of assurance requirements.

*Note that each reporting year is relevant to the respective group that a company qualifies under (the criteria for qualification under each group is summarised at the bottom of this page). The phase-in period is summarised below:

Timeline of AUASB’s Phase-In Period

Why Entities Must Ensure Compliant Disclosures

Timely, transparent, and compliant climate-related disclosures under AASB S2 help businesses mitigate financial and reputational risks—inaccurate or misleading reporting can lead to civil penalties, legal scrutiny, and loss of investor confidence. Furthermore, as more businesses disclose climate-related risks and opportunities, investors will increasingly prefer transparent businesses that demonstrate proactive climate risk management and resilience strategies to make informed investment decisions and ensure they remain financially viable in the future.

How Cress Can Help

Cress specialises in assessing the impacts of climate risk across business operations, assets, people, and the value chain, as well as identifying opportunities to increase resilience, reduce emissions, and cut costs. We can help you conduct scenario analyses and develop transition plans in line with requirements. Cress also has significant experience in undertaking greenhouse gas calculations for scope 1, 2, and 3 emissions and setting clear metrics and targets.

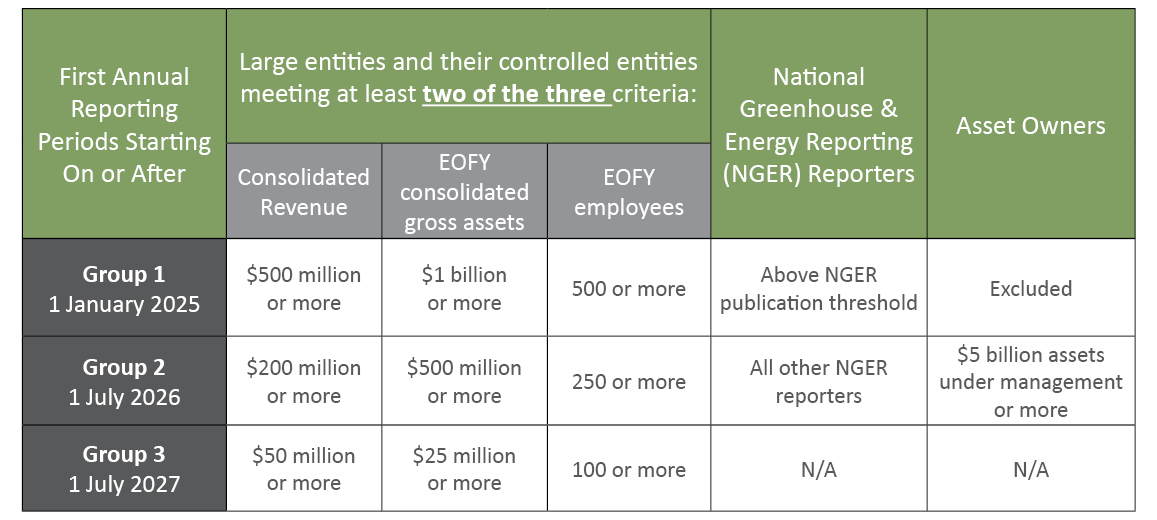

Criteria for the Three Effective Dates, Based on Qualification in Group 1, 2 or 3:

From Compliance to Leadership in Sustainability Reporting

With AASB S1 and S2 now shaping the future of sustainability and climate reporting, businesses that move beyond compliance and integrate sustainability in corporate strategy and decision-making will gain a competitive edge.

At Cress Consulting, whether uncovering sustainability opportunities under S1 or preparing for climate-related financial disclosures under S2, we help businesses leverage disclosure to drive meaningful action. Contact Cress Consulting today.

Please get in touch or request a call with one of our team to learn more.